There is only one week left until we enter the year 2024. Before entering the new year, I wanted to chat a little about it by comparing the returns the markets have brought to investors in the past 10 years. I hope that this article, which will appeal to all kinds of investors, will also be useful to all kinds of investors. I wish you a happy Christmas and wish the new year to bring health and happiness to all of you.

INDICES

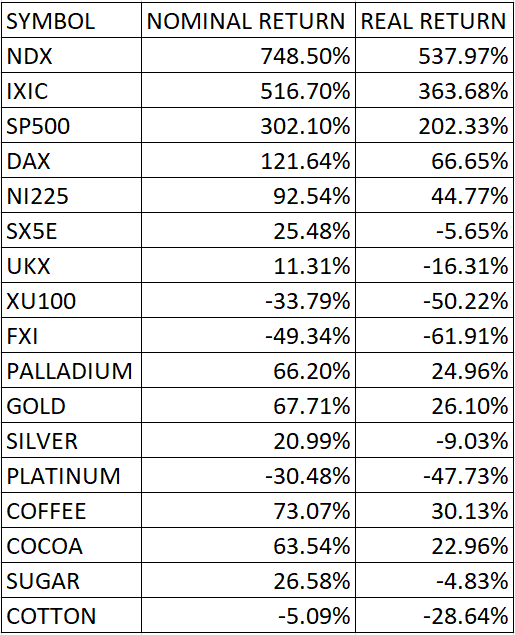

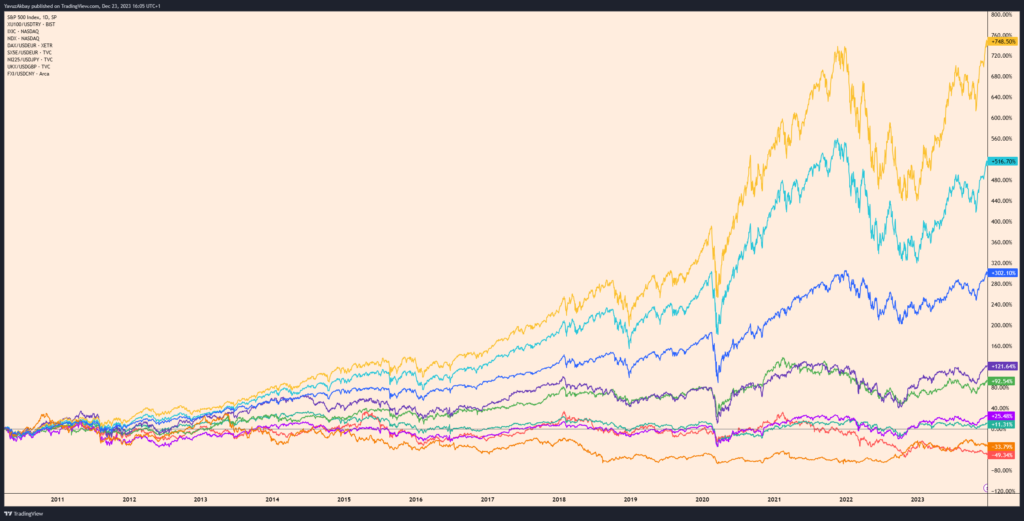

I would like to start my article by comparing the 10-year returns of world indices. To make the comparison fair, I normalized all indices to the dollar. Thus, we can see the returns of all indices in dollar terms.

In comparison, the peak is the Nasdaq 100 index. The index, which has made extraordinary profits especially because it includes the stocks with the 100 largest market values of the Nasdaq Composite index in its portfolio, has achieved a return of 748% in the last 10 years.

Nasdaq is in second place again. But this time it’s the Nasdaq Composite index. Since this index contains more stocks (2500) than Nasdaq 100, its return is lower than Nasdaq 100. However, it still manages to be the second highest return index with a return of 516%.

The third index is also an American index. SP500 manages to be the 3rd best return index of the last 10 years with a return of 302% in the last 10 years.

Therefore, the indices that have brought the highest returns in the last 10 years have been American indices by a large margin. In my opinion, this return ranking will not change in the next 10 years, especially if investments are made in US companies with large market values. I think that even higher returns can be achieved if we focus on energy stocks, especially in addition to technology.

Germany’s DAX index ranks 4th. The index, which brings a very good return of 121%, is especially appealing to investors with low risk appetite. I think it makes sense for investors who do not want too much volatility but want good returns to turn to German stocks.

Behind the DAX index is Japan’s Nikkei 225 index. This index also seems to have exhibited movements in positive correlation with the DAX for a long time, bringing very similar returns to the DAX. Although the index, which has brought a return of 92% in the last 10 years, has performed well, its downward trend, especially after 2021, scares me. But I can say that it has very good opportunities if it breaks out of this downward trend.

STOXX50 index appears to be an index that has brought a return of 25.48% in dollar terms in the last 10 years. Although there seems to be a return, the fact that dollar inflation in the last 10 years has been around 33% shows that the real return of the index is actually negative. Although I am not sure about its subsequent performance, I can say with certainty that the real return of the STOXX50 index in the last 10 years has unfortunately been -5.65%.

Next is the United Kingdom’s FTSE index. The index, which was struggling to survive in dollar terms and brought a nominal return of 11.31%, suffered a loss of approximately -16.31% in real terms. Although the upcoming period does not look very positive for FTSE, which has had a difficult 10 years, we hope the situation will change.

The next index is Turkey’s Borsa Istanbul index, which has a nominal return of -33.79% and a real return of almost -60%. If you are looking for an index that is both extremely risky, extraordinarily volatile and in which you will lose 60% of your investments, you are at the right address. I started my weekly reports and blog posts in 2021, and since the day I started, I have not recommended entering the Borsa Istanbul index to anyone who follows me and reads my articles, and I still do not. From time to time, out of necessity, I entered the index and made analyzes to remove the ones that were at a loss, somewhat harmless. But other than that, I definitely do not recommend it to those who have never been involved.

The last index on the list is the FXI fund, which includes various stocks of China. When we combine a loss of up to 50% with dollar inflation, we get a loss of 77%. The difference between the Chinese index and Turkey’s is that the volatility is lower. Therefore, the FXI investor has been losing money steadily, especially since 2021. I think that anyone who does not want to lose money should not step into this index, except for investors who like to make themselves suffer. If conditions change, it can be brought back to the agenda.

You can find the return table of the indices in the last 10 years end of the post.

PRECIOUS METALS

When we compare the returns of precious metals in the last 10 years, we see that palladium and gold have closed their 10th year at par. The nominal returns of both appear to be around 67%. But there is a very important fact here, which is the extraordinary volatility of palladium and the figures it reached in 2021. Palladium’s performance after 2022 is really bad compared to gold. The reason for this is that the risk and volatility of gold is very low and it closed the year with 67%. Therefore, gold looks much more attractive for any investor. Of course, it is useful to express it again. We do this analysis by considering a 10-year return. In other words, if someone who bought palladium in 2014 sells that palladium in 2021, he will get more of the volatility. However, an investor who has held palladium for 10 years is at a loss in terms of opportunity cost than an investor who has held gold for 10 years.

On the contrary, I have optimistic thoughts about palladium and gold. I think that in the next 10 years, these two metals will be at higher levels than they are now. Therefore, while I see palladium as ideal for investors who like risk, I think gold is suitable for investors who like stability.

In addition, silver, in the 3rd place, unfortunately does not look very bright with a nominal return of 20%. This is because the real return is negative. We saw that silver was very stagnant, especially after 2021. But I think at some point silver will get the value it deserves. Therefore, I have full confidence that the return of silver will turn positive in the next 10 years.

Platinum has been nominally negative for almost 9 of the past 10 years. 30.48% minus year; I can say that it caused great distress to its investors by closing at 47.73% minus in real terms. Would I add platinum to my portfolio when there are palladium and gold? I do not think so.

You can find the return table of the precious metals in the last 10 years end of the post.

COMMODITIES

When we look at the commodities, we can see that especially coffee is the commodity that has gained the most value in the last 10 years. Although coffee showed a poor performance after 2022, it completed its 10th year with a nominal return of 73.07% and a real return of 30.13%.

Cocoa is in second place. With a nominal return of 63.54% and a real return of 22.96%, cocoa has become the best performing commodity among commodities, especially as of mid-2022. A correction is possible in the coming period, but I think this is a good upward trend.

We see sugar in third place, with a surprising decline in the last quarter of the year. Sugar, which has achieved a very good rise since the middle of 2022, just like cocoa, unfortunately showed once again that it is a very sensitive commodity to external shocks. I think that sugar, which completed the year with a nominal return of 26.58%, first with a decline in the middle of 2023 and now with a decline at the end, should now end its decline at these points.

Finally, despite the extraordinary run of cotton after 2020, the catastrophic decline in the middle of 2022 left its investors negative in both nominal and real terms in its 10th year.

You can find the real and nominal returns of all the indices, commodities and precious metals I compared in the table below.