In November, the United States witnessed a further slowdown in inflation, raising optimism about the Federal Reserve’s successful navigation towards a soft landing for the nation’s economy. Consequently, the S&P 500 saw a 0.2% increase, bringing it within 1% of its all-time high in January 2022. This positive trend marks the eighth consecutive week of gains for the index, a feat last accomplished in 2017, and positions it for one of the best years in the past decade amid a volatile 12-month period.

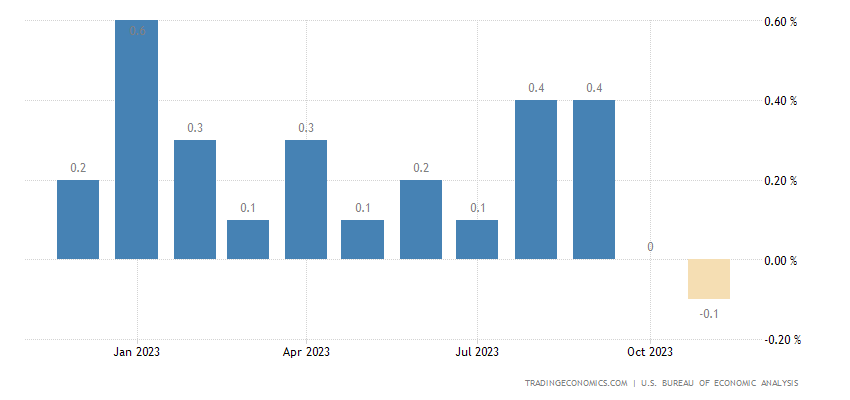

Economists are increasingly convinced that the inflation concerns post-pandemic are waning, anticipating significant interest rate cuts in the upcoming year. Inflationary fears appear to be slowly being alleviated. Notably, core PCE inflation, which excludes volatile energy and food prices, rose by only 0.1% month on month in November, which was slightly lower than expected. The six-month annualized rate is now 1.9%, just below the Federal Reserve’s 2% inflation target. The Federal Reserve’s recent pivot, indicating that interest rates will be cut in 2023, has boosted investor confidence. Futures markets are now pricing in up to six interest rate cuts in 2024, implying a move from the current 22-year high of 5.25% to 5.5%. Wall Street’s positive sentiment, coupled with low unemployment rates, is fostering predictions of a soft landing for the U.S. economy. This comes after a period of high inflation prompted the Fed to raise interest rates, a move that was expected to precipitate a recession.

Recent GDP data revealing 4.9% annualized growth in the third quarter and expectations of modest growth in 2024 support the notion of a strong and resilient US economy. The United States has outperformed other major economies, exhibiting faster growth and sharper price pressure declines. I believe the Fed will cut rates before the European Central Bank or the Bank of England. According to a Michigan University poll, consumer sentiment in the United States has risen 14% in the last month as economic optimism grows.

Citi economists, on the other hand, advise caution, pointing out that an overly optimistic interpretation of the data may overlook the persistent rise in prices, particularly in the services sector. They emphasize that the weakness in core inflation is due to significant deflation in goods, which may not be a sustainable means of meeting the inflation target.

Potential risks to the optimistic economic outlook include disruptions to global trade in the Red Sea, where Houthi rebels have targeted commercial vessels. Despite the recent shift in stance, Fed policymakers still expect three rate cuts this year, indicating a significant shift from their previous insistence on maintaining tight monetary policy until inflation was well under control.