In this article, I will examine Nvidia’s financial situation, stock pricing, various statements of Nvidia CEO, and Nvidia’s future from my perspective. Nvidia announced its 2024 first quarter earnings figures. Earnings of $26 Billion were announced, up 18% from the previous quarter and 262% from a year ago. In addition, it has been confirmed that Nvidia will undergo a 10-to-1 stock split. Jensen Huang, founder and CEO of NVIDIA, said, “The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” he said.

After these statements and these earnings figures, investors and the press were divided, especially in X. While some said that the stock was a bubble and that the company was actually a pile of garbage, others said that the company was very cheap at the moment and could reach the $1500 level very soon. So which way am I closer here? I both think that Nvidia is a strong, promising and solid company, and that its price is baloon.

First of all, let me start by establishing why Nvidia is a solid company. Looking at the revenue, excluding this year, Nvidia’s earnings have increased by an average of 26% and assets by 32% every year since 2017. In addition, when I look at the Piotroski F-score, which is one of the evaluations that measure the robustness of a company, I see that the company received 8 points. This indicates that the company is among the strongest of the mega-cap stocks in Nasdaq. In terms of debt management, which is one of the biggest signs of a company’s sustainability, Nvidia passes the test very well. With its 0.30 Debt/EBITDA and 0.252 Debt/Equity ratio, Nvidia appears to be the most sustainable and robust company among mega-cap stocks after Google in the long term.

Nowadays, with the extraordinary development of the artificial intelligence sector and its adoption in every field in recent years, Nvidia cards and the platforms created by Nvidia have become indispensable for artificial intelligence developers and systems running artificial intelligence. The fact that there is no company of Nvidia’s stature that can stand against Nvidia in the field of artificial intelligence makes Nvidia an indispensable monopoly in the sector. In addition, Nvidia’s collaboration with companies operating in almost every branch of the technology sector such as Microsoft, AWS, Siemens, IBM and SAP reveals that it has become a monopoly in the sector. Currently, the two companies that can stand against Nvidia appear to be ARM and AMD. Therefore, in the future of technology, I think that if things continue like this, Nvidia will strengthen its place and will not collapse easily. Of course, tomorrow there may be a very different development and Nvidia may suddenly be shattered, we have seen so much in these markets over the years. However, looking at its current financials, the company is in a constant growth and with its collaborations, the company continues to grow further and dominate the market. Therefore, I can easily say that the company will further strengthen its position.

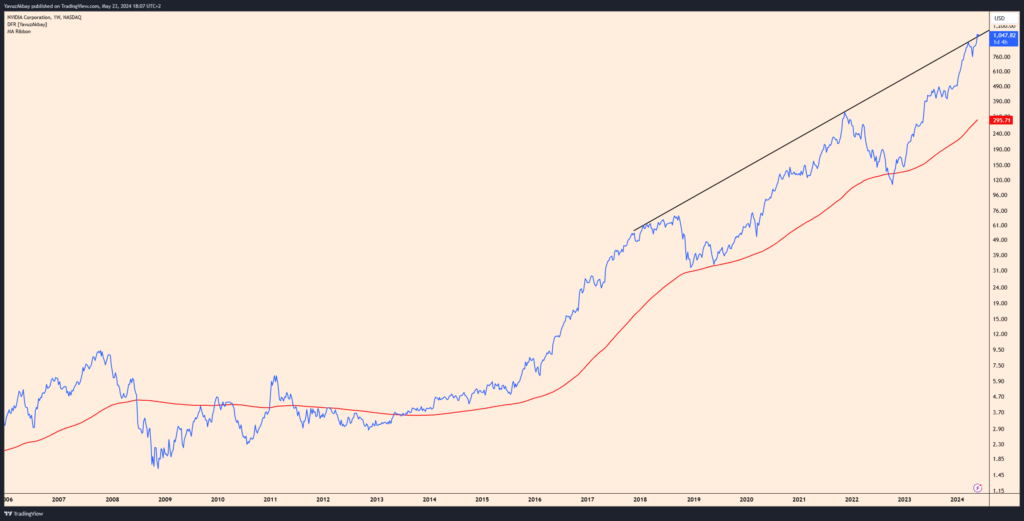

So how can such a good company have a ballooning price? In fact, the company’s bubble comes from the index, not the company itself. The market environment created by the USA thanks to its “perfect” economic policies has now inflated the SP500 and Nasdaq index more than ever before in history. The rise of the index normally created a bubble effect, more intense in some stocks. Nvidia comes first among these stocks. A few days ago, I shared a really nice technology sector evaluation study on my X page. In this evaluation, I focused on technology stocks, especially since Nvidia’s earnings figures were to be announced. I made the first of the evaluations by analyzing the P/E ratio. In this analysis, Nvidia’s fair value or intrinsic value came out to be around $320. This is not surprising to me because when I do technical analysis, I clearly see that the level where the correction should be made is around $300. Secondly, in P/S revenue growth evaluation, one of the analyzes that I find most useful, I see that Nvidia is 5 times more valuable than other companies in the sector in terms of price. So no matter what valuation I make, it becomes clear that Nvidia is currently much more expensive than other stocks in the industry. If we take into account that all companies in the sector are slightly inflated with the index, the situation becomes more incredible and the price of Nvidia stock is currently determined as the most overvalued share in the market.

So how should we respond to the stock split at this point? A stock split is neither bad nor good for a stock. Although it is normally this easy, it is generally a move made when the stock becomes increasingly expensive. By dividing shares, the company paves the way for small investors to continue investing. I think there is a short-term funding target here as Nvidia tries to attract investment from small investors. Unfortunately, this will be a move that will damage the confidence of long-term investors.

In conclusion, Nvidia is a solid company, but it is too expensive. I think that Nvidia, which is currently trading at $1048, should be priced between $300-400.