As we all know, the stock market, precious metals and cryptocurrencies are tools for investors to protect their investments against inflation and generate relatively high income. But I see that today, regardless of the investment instrument, the prices of these investment instruments are evaluated based on nominal prices and shares are made in this way everywhere. For example, these days we started to receive news that Japan’s stock market index NIKKEI225 has returned to its 1989 peak. According to our friends who wrote the news, a person who invested in the index in 1989 seems to have covered his losses now. But is this really the case?

Of course not. When we first normalize the index to Japan’s inflation, then convert it to the reserve currency, the Dollar, and normalize it to dollar inflation, we clearly see that the index is still circulating at the levels of 2006.

So, does this mean that the Japan index has succumbed to inflation? No. This means that it is much more logical to buy and sell by looking at the inflation normalized version of the index, rather than looking at its nominal price. Of course, opportunity cost and time cost are still factors that need to be taken into consideration, but at least we see a value much closer to the real value on the board.

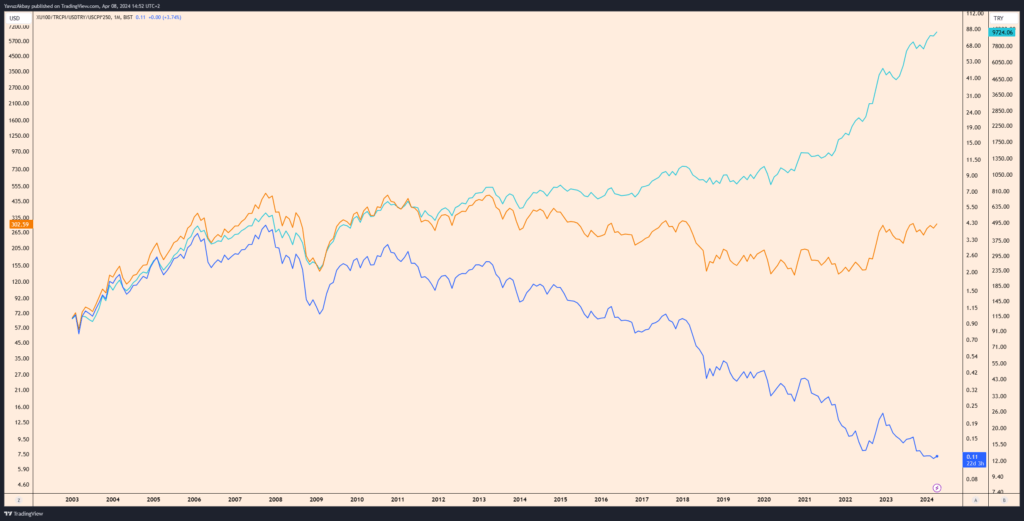

When we look at the stock market index of Turkey, which has deliberately devalued its own currency with economic policies that are not in line with economics in the past years and has continued this depreciation by continuing to print money, we can see the reflection of inflation and the depreciation of the foreign exchange on the stock market index much more clearly.

Light blue shows the nominal value of the index, orange shows the index normalized to the dollar, the reserve currency, and dark blue shows the index normalized to dollar inflation.

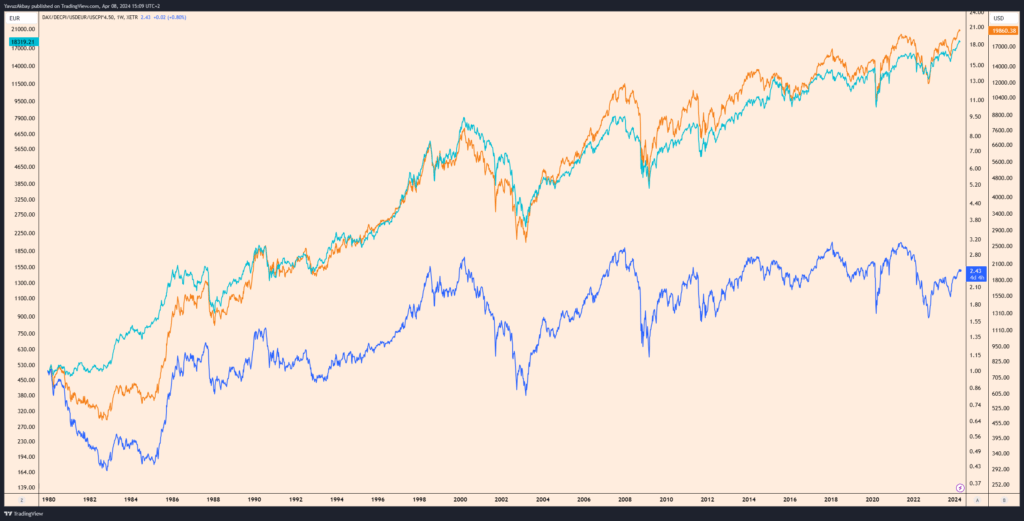

Likewise, FTSE is one of the indices that lost over 40% of its value when normalized to dollar inflation. So, are there any indexes that always remain in profit even though they are normalized to inflation? Yes there is. Chief among these is Germany’s DAX.

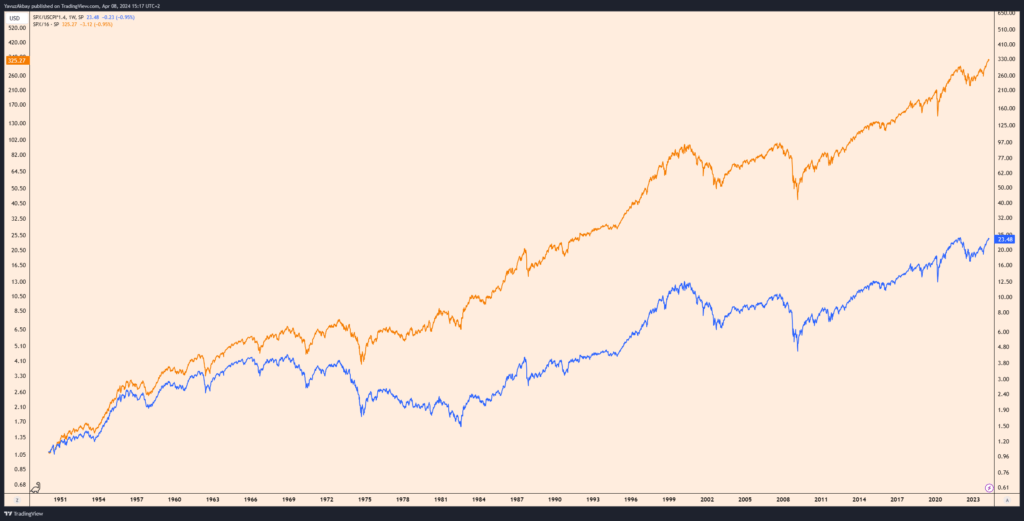

Even when normalized for inflation, the DAX has not made any losses since 1980, except in very rare circumstances. In addition, the indices that are more profitable than DAX are generally American indices. In nominal terms, the SPX appears to have made a profit of 325 times in nominal terms since 1950, and 23 times when normalized to inflation.

In addition, the indices that are more profitable than DAX are generally American indices. In nominal terms, the SPX appears to have made a profit of 325 times in nominal terms since 1950, and 23 times when normalized to inflation.

NASDAQ is another American index that makes a splash. The index, which has brought a nominal return of 144 times since 1985, seems to have brought almost a 50-fold return when normalized to inflation.

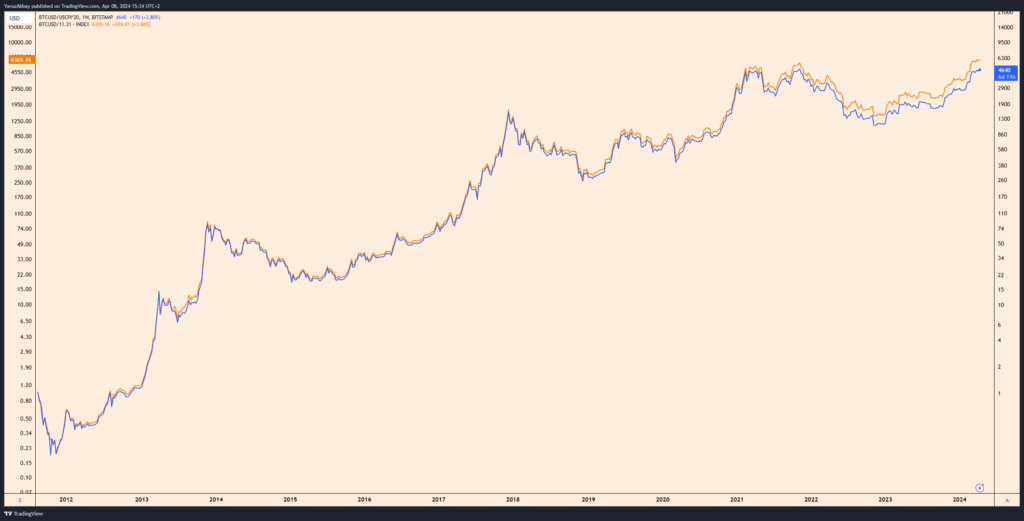

Gold is one of the instruments that seems profitable when normalized to inflation. However, when looking at Bitcoin, it is possible to say that there is not much of a difference, at least in the long term. Bitcoin is always profitable.