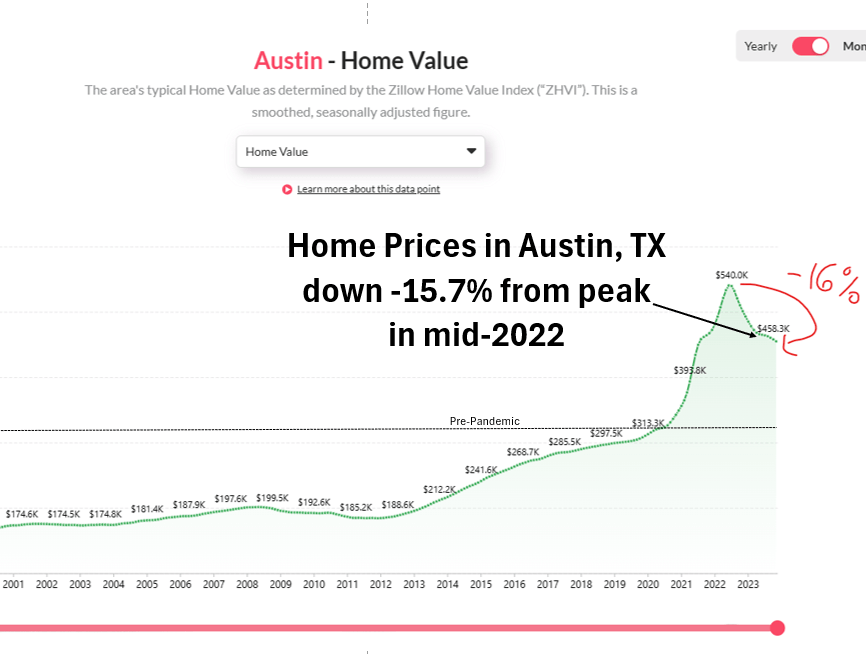

The Austin, TX housing market, once a beacon of growth, is now facing turbulent times, signaling a potential shift in the broader U.S. housing landscape. As of mid-2022, home values have plummeted by 16% from their peak, sounding a cautionary alarm for the rest of the nation’s real estate market.

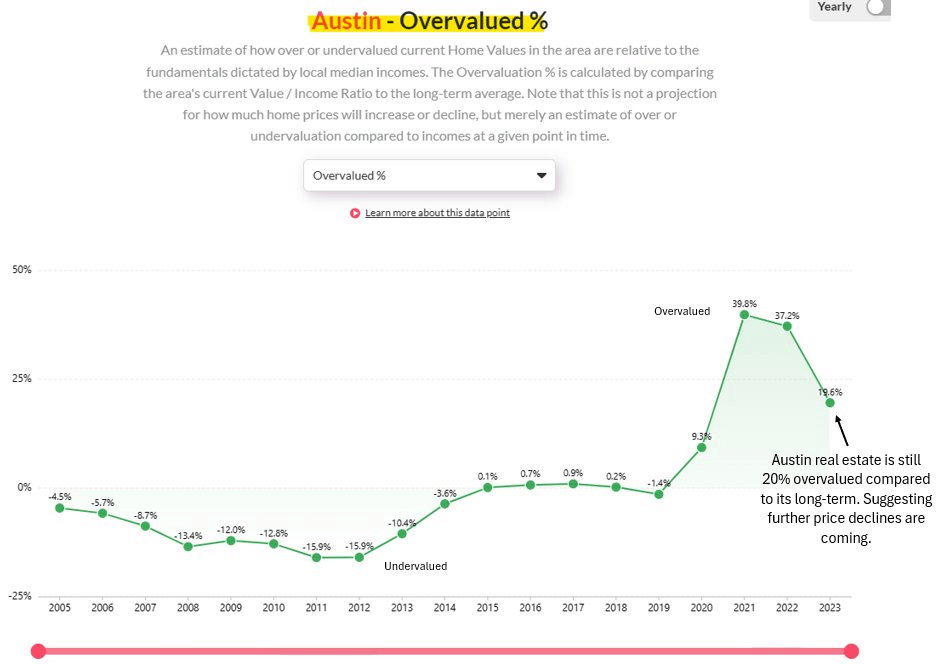

Current State of Austin’s Housing Market: Despite the significant drop in prices, real estate in Austin remains relatively expensive, maintaining a 20% “overvalued” status compared to long-term norms. This overvaluation hints at the possibility of further price declines looming over Austin’s housing market.

Inventory Explosion and Price Drops: Austin’s vulnerability to price drops is exacerbated by the explosion of inventory levels, reaching a record high of 7,319 homes for sale in December 2023— the highest level in the past seven years. This situation raises concerns about what could happen to the U.S. housing market at large if inventory levels were to spike in 2024.

Potential Impact on Other Cities: The Austin model serves as a warning for cities like Denver, CO, Nashville, TN, Tampa, FL, Dallas, TX, San Antonio, TX, and Salt Lake City, UT. These areas are experiencing a surge in inventory while prices remain overvalued, setting the stage for potential price declines in 2024.

Nashville and Tampa: A Closer Look: Nashville and Tampa stand out as potential candidates for significant price declines. Both cities exhibit similar inventory trends to Austin, with values in Nashville remaining 31% overvalued and Tampa facing a staggering 33% overvaluation, making it one of the most overvalued housing markets in the U.S.

Concerns and Caution for Homebuyers and Investors: Using the Reventure App’s valuation metrics, concerns are raised about the detachment of current prices from historical norms. In markets like Tampa, prices today are more valued than they were during the peak of the 2006 bubble, prompting caution for homebuyers and investors.

Hope on the Horizon: Despite the unsettling trends, there is hope. As seen in Phoenix’s example, markets can become fairly valued or even undervalued after a period of decline. A careful understanding of valuation trends lays the foundation for anticipating future market dynamics.

The Importance of Valuation Trends: The final point emphasizes the significance of understanding valuation trends in local markets. A market that is 30% overvalued may not experience appreciation but rather declines. On the other hand, fairly valued markets, like Chicago, may see corrections but are less likely to undergo severe downturns.

In conclusion, the current state of Austin’s housing market serves as a bellwether for potential challenges across the U.S. Understanding these trends and exercising caution in overvalued markets is crucial for both homebuyers and investors as they navigate the complex landscape of real estate.