Half a decade ago, proposing the idea that China was on the brink of a severe economic crisis might have been met with skepticism. Nonetheless, a decade ago, signs were evident that a substantial economic downturn loomed in China’s future.

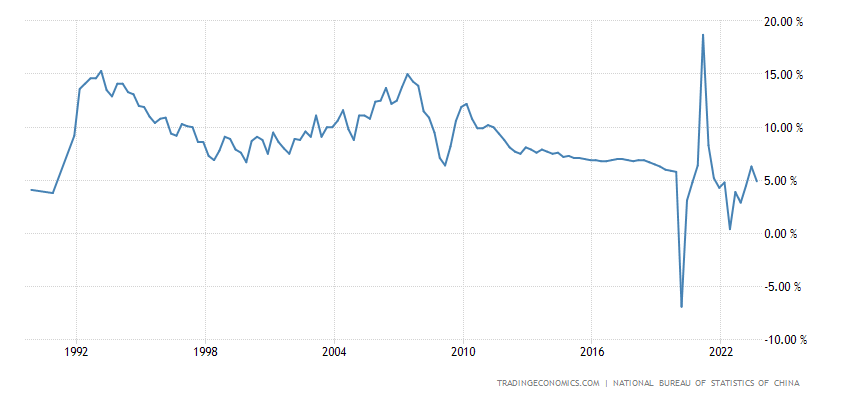

Having experienced robust growth at around 10% for an extended period (with an average growth rate of 10.65% and 10.84% in the 1990-2000 and 2000-2010 periods, respectively), China raised concerns when its economy expanded by 8.1% in 2013 and 6.75% between 2010 and 2020. This growth trajectory challenged the perception of the “Chinese miracle,” revealing it to be more of a fantastical tale than a miraculous reality.

Despite being the sole expanding economy in 2020 and achieving an 8.1% growth in 2021, optimistic sentiments were shattered with the announcement of a mere 3% growth rate in 2022, casting doubt on the country’s economic outlook. This revelation brought to light long-overlooked financial and economic issues, notably the real estate crisis, with numerous shadow banking institutions associated with this crisis facing severe bankruptcies.

China’s strategy for inflation protection was straightforward: maintain low domestic demand for consumer goods, encourage people to invest in construction projects, and foster the belief that they possessed savings in properties they could never truly own (as houses in China are leased for 75 years). This plan had proven effective for an extended period, leading people to invest 80% of their savings in these construction projects, not only investing but also borrowing extensively over an extended duration.

On the flip side, this model gave rise to numerous construction firms. Despite lacking the essential capital, many companies undertook extensive construction projects. Aware of their financial shortcomings, these companies initiated these projects with the optimism of future profits or the anticipation of customers who would pay substantial amounts in advance. When these expectations were not met, the only recourse left was to issue bonds, borrow funds from various shadow banking institutions, and mortgage the projects to these same institutions. While companies experienced growth, their debts did not diminish; instead, they escalated day by day. Recognizing that this situation would inevitably lead to significant bankruptcies, the Chinese administration attempted intervention in both 2014 and 2021 but met with failure.

A digression about China’s shadow banking institutions is warranted here. In the 2008 mortgage crisis, the entire real estate bubble burst in just four years, primarily because many loans in the risky housing market came from hedge funds. In China, the majority of lenders were companies operating in the construction sector. For instance, Zhongzhi Enterprise Group, which declared serious bankruptcy last month, was primarily involved in timber manufacturing and trading. In contrast to other similar institutions worldwide that provided financing through monetary loans, China’s system was largely based on construction materials and equipment. Additionally, the widespread practice of maturity extension in China, similar to that in Turkey, allowed constant deferral of debts. These factors significantly prolonged the bursting of the real estate bubble in China.

Despite the slowdown in growth, it could have taken much longer for the housing bubble and debt crisis to burst. However, the progression was expedited first by trade wars and then by the Covid-19 pandemic. The closure of cities and even states, particularly due to China’s zero Covid policy, led to a halt in construction and a sharp decline in sales. When Covid restrictions were lifted, contrary to expectations, housing sales did not rebound. The catalog sales system in China, where residences and workplaces are sold before the project even begins, began to cause concern, making people apprehensive about purchasing houses they might never own. Nevertheless, many companies relied on this method to secure a significant portion of their financing needs, necessary to revive construction sites that came to a standstill during the pandemic. The halted construction sites were on the brink of turning into a social explosion, as millions of Chinese invested money in these projects, aspiring to live in modern houses that either remained unfinished or were in rough construction.

To prevent this explosion, public construction expenditures were initially increased, enabling these companies to generate income from non-residential ventures. Subsequently, substantial loan packages were implemented. Despite providing $498 billion in loans in 2021, rescue packages of $29 billion, $120 billion, $168 billion, $192 billion, and $157 billion were extended to the still struggling sector in 2022. The Central Bank of China and the Chinese Communist Party, despite expressing opposition to monetary expansion, executed what can be deemed the world’s biggest financial maneuver by utilizing reverse repo, reserve requirement freedom, and private and public banks as sources of money supply for these loan packages and similar initiatives. While the USA’s M2 money supply, often criticized for monetary expansion, increased by 35% between 2020 and 2023, China’s M2 money supply surged by 46%. Although the construction sector, constituting 25% of the Chinese economy directly and indirectly, was expected to benefit the most from this situation, the anticipated recovery never materialized as it reached its final phase.

Apart from the economic recovery efforts, a quarter of China’s top 50 construction companies, including Evergrande, Kaisa Group, Modern Land, Country Garden, and Fantasia Group, faced defaults and some even went bankrupt. The gravity of the situation becomes evident when considering that Evergrande alone owes money to 128 banks and 121 shadow banking institutions. This crisis is substantial and profound, prompting China to make extraordinary efforts to downplay its severity.

An additional indicator of the crisis’s magnitude is the comparison with the 2008 financial crisis in the USA. Despite China’s direct credit support of 1.5 trillion dollars, a sum almost equivalent to the total monetary expansion of 1.9 trillion dollars used by the USA to overcome the 2008 crisis triggered by Lehman Brothers’ collapse, the impact remains significant. Bankruptcies not only increased but also failed to subside, highlighting the challenges China faces.

In the less-discussed aspect of China’s economic crisis, a banking crisis akin to the 2001 economic crisis in another country is unfolding. Starting with the collapse of Baoshang Bank in 2019, with assets totaling 431 billion dollars, the crisis expanded to seize five additional banks, including New Oriental Country Bank of Kaifen, Yuzhou Xin Min Sheng Village Bank, Shangcai Huimin County Bank, Zhecheng Huanghuai Community Bank, and Guzhen Xinhuaihe Village Bank in April 2022. Remarkably, this crisis reached even China’s and the world’s largest banks, the Bank of China and the Industrial and Commercial Bank of China. Despite the bankruptcies of Signature Bank and Silicon Bank Valley, totaling 275 billion dollars, the lack of discourse around the collapse of Baoshang underscores China’s intense propaganda efforts and closed nature.

Another complicating factor in China’s banking crisis is the lack of auditability in its vast banking system, which comprises more than 4,600 banks. The intertwined relationship of interest between these banks and the local administrators of the Communist Party exacerbates the depth of the banking crisis in China.

While China is expected to overcome this series of crises, the aftermath suggests that its 30-year achievements may be entirely erased. Predicted five years ago to become one of the countries with the highest per capita income in the 2030s, China now faces challenges escaping the middle-income trap due to an aging population and the current crisis.