In this article, I will analyze Mercedes Benz stock. This analysis is only intended to give an idea, not investment advice.

The company has reported a decline in profits and reduced revenues in recent months due to challenges from electric vehicle competition. Mercedes’ EBITDA revenue fell nearly 7% to 5.06 billion, down 1.4% to 39 billion; Both are below analyst estimates. When I look at electric vehicles. Mercedes stated that it operates in a subdued market with intense price competition. Additionally, CFO Harald Wilhelm noted that the EV market is “a pretty cutthroat space,” adding, “I can’t imagine the current status quo being completely sustainable for everyone.” So it’s not very good there. Mercedes, on the other hand, stated that it still aims for a 50% hybrid and EV global sales mix by 2025. From now on, it claims that it will sell only electric vehicles in 2025. Mercedes was in good shape before this. They were selling high-end, high-priced vehicles and making good margins and sales there. Right now they’re using those profits to subsidize the electric vehicle transition.

Although the news does not seem good, there are promising plans for the coming period. Therefore, I take the news positively. Now let me evaluate Mercedes’ financials.

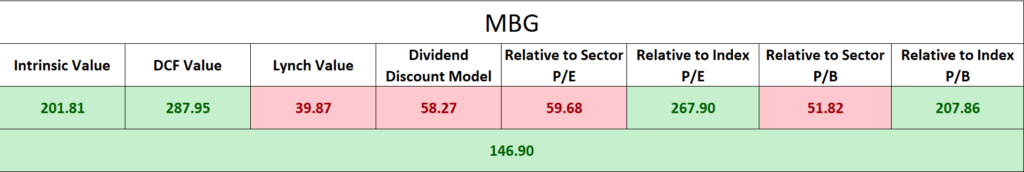

First of all, when I apply Graham valuation to the company, I see that the intrinsic value is 201.81 euros. Then, when I do the discounted cash flow analysis, I come across a price of 287.95 euros. Both of these analyzes are priced well above the current market price of 63.56 euros. Later, when I analyzed it using Peter Lynch’s technique, it was 39.87 euros; When I analyze the dividend discount model, I get results that are lower than the current price, such as 58.27 euros. Finally, when I analyzed it according to the substitute companies in the sector, it was 59.68 euros in the P/E analysis; In the P/B analysis, I get the results of 51.82 euros. These prices are very close to the current price. 267.90 euros in P/E analysis according to the index, not the sector; In the P/B analysis, I encounter results such as 207.86. This means that the company is valuable relative to its sector, but very cheap relative to its index.

The average result in the evaluations is 146.90 euros. If we consider that Mercedes Benz shares are currently 63.56 euros, it turns out that there is more than twice the premium potential.

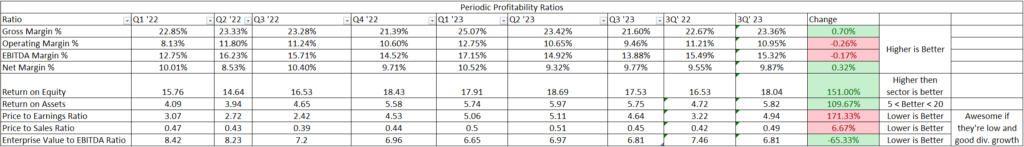

I would like to support this analysis with periodic profitability ratios. When I look at gross and net margin, the company experienced an increase of 0.70% and 0.32%, respectively, compared to the previous period. Since the net margin change is low, I cannot take it as a meaningful value, but the gross margin looks pretty good. Operating margin and EBITDA margin decreased by 0.26% and 0.17%, respectively, compared to the previous period. Since these values are below 0.40%, I think they are not very meaningful values, but investors who wish can include them in their analysis.

When I look at Return on Equity, I see an increase of 151% compared to the previous period. Currently at 18.69, Return on Equity is at a much higher point than substitute companies in the sector. This is a very positive indicator. When I look at Return on Assets, the company recorded an increase of 109.67% compared to the previous period. This is a very positive indicator. At the same time, Return on Assets escaped the 5 threshold by rising to 5.75. This also appears as a positive indicator.

When we look at the P/E and P/S ratios, I see that both ratios have increased compared to the previous period. P/E recorded an increase of 171.33% while P/S recorded an increase of 6.67%. Although the rise is a bad signal, the fact that these two indicators are lower than the sector are indicators that the stock is still cheap. The fact that dividend increases are constant while these indicators remain low is also a very positive indicator. In addition to these indicators, it is also very important to look at EV/EBITDA. EV/EBITDA showed a decrease of 65.33% compared to the previous period. This decline also indicates that the stock has become a little cheaper.

As a result, when we evaluate the financials, the average value of the stock is 146.90; highest 287.95; I conclude that the lowest is 39.97. Periodic profitability ratios indicate that the stock is more likely to see high levels.

When I look at it technically, I think Mercedes’ run will begin this year, especially with the breaking of the 75 euro resistance. It is a fact that sooner or later it will reach 146 euros, which was Mercedes’ target for years.