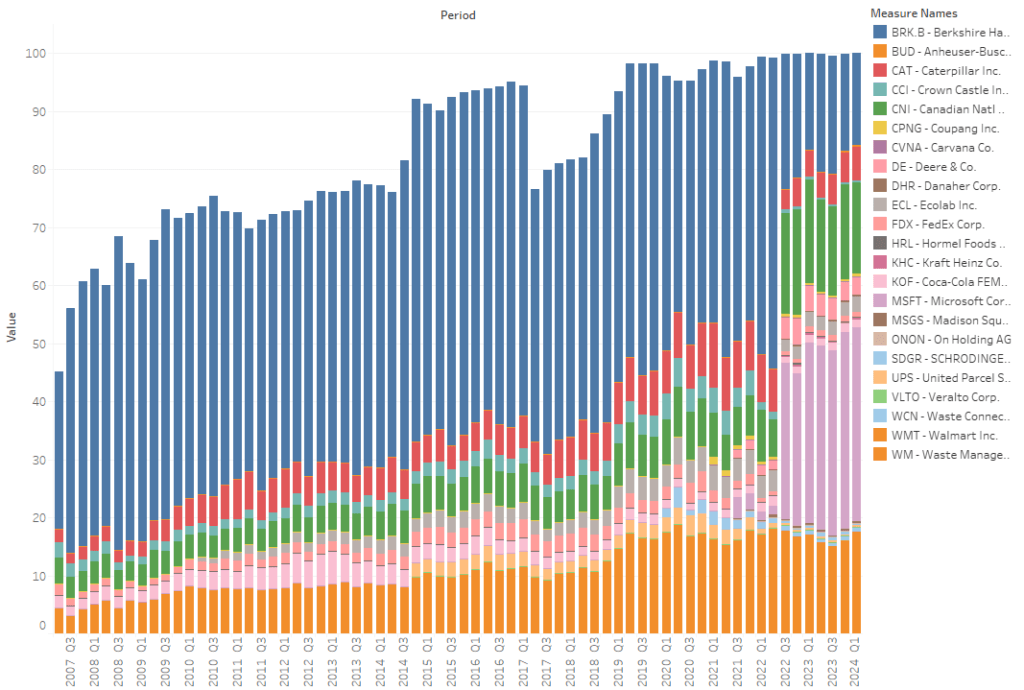

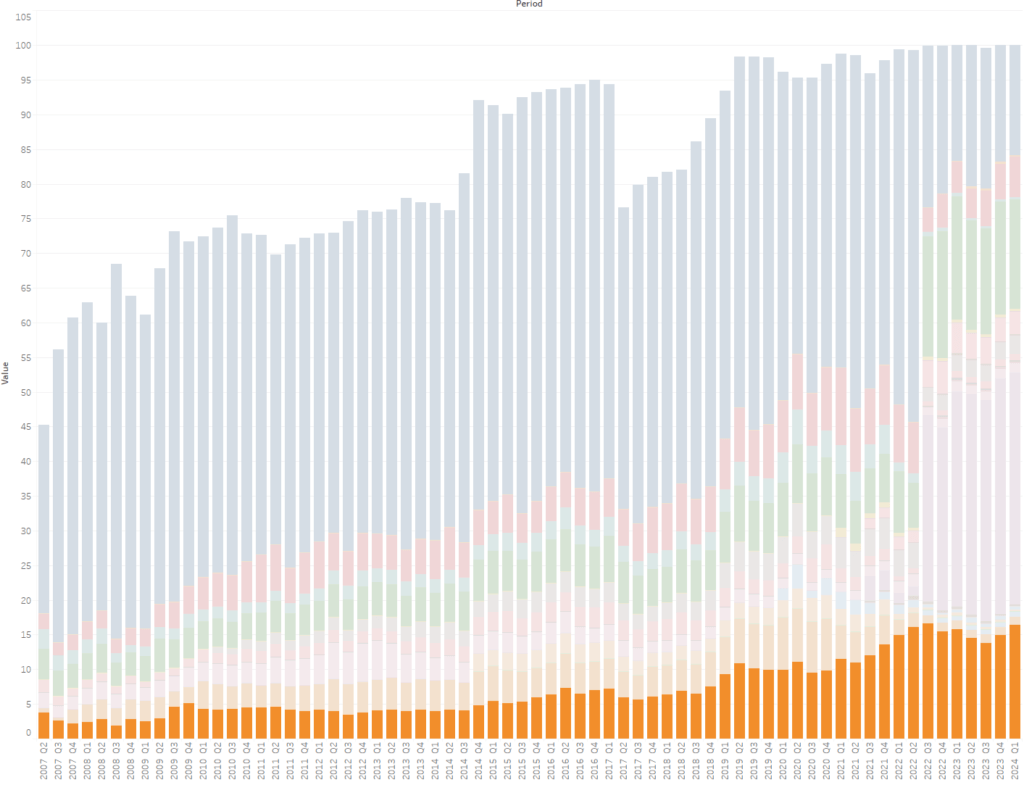

I will explain the portfolio management strategy by analyzing how and why the portfolio of Bill & Melinda Gates Foundation Trust, one of the most followed portfolves by Nyse investors, has been shaped since 2007.

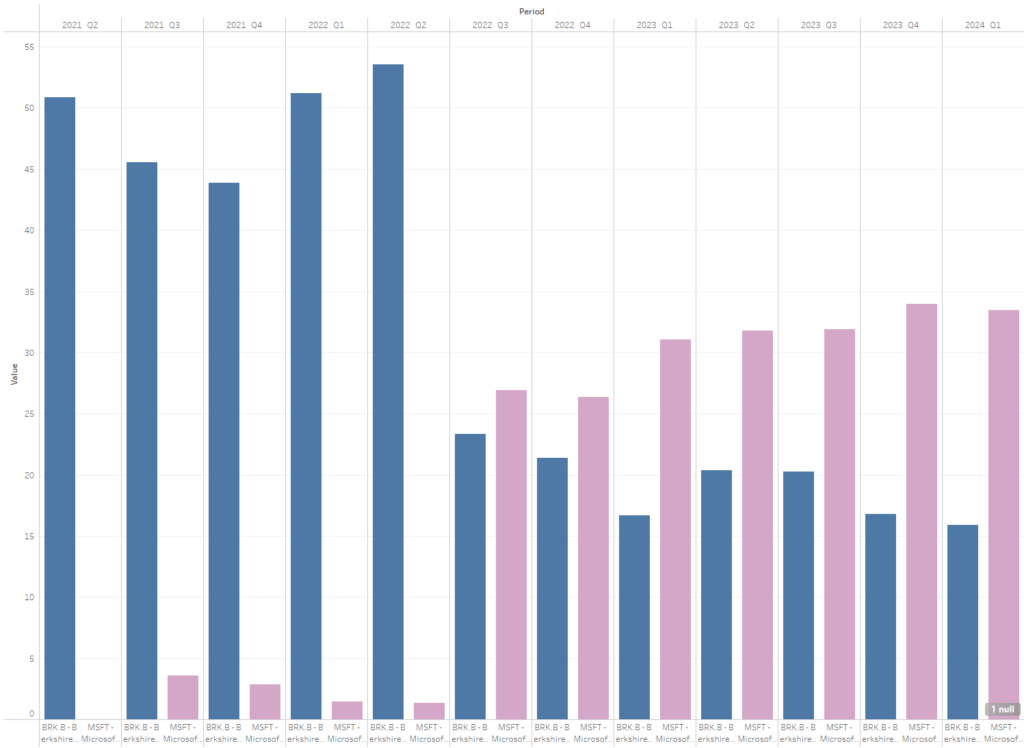

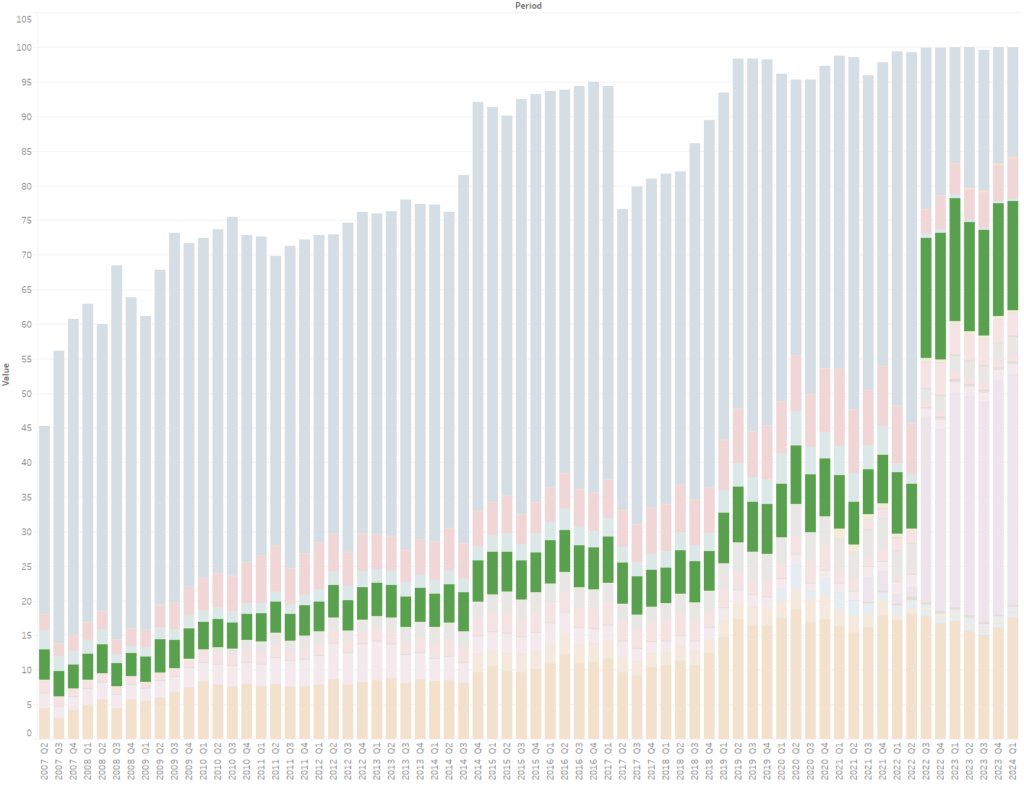

First of all, there are 24 shares in the portfolio and the portfolio value is currently at $45.859.445,000. Michael Larson has been management since 1994, not the portfolio Bill Gates itself. The last change in the portfolio was made in Microsoft and Berkshire Hathaway shares during the weeks we went to. Microsoft’s share in the portfolio was 4.48% and Berkshire’s share in portfolio was reduced by 13.12%. In particular, it should be focused on continuing to be continued to be continued continuing continuously after the drastic reduction of Berkshire’s portfolio in 2022. The reason for this is that Berkshire Median for years from 2007 to 2022 covered the portfolio around 47.55%, while this rate was currently declining to 15.87%. But what happened to Larson, he’s starting to draw his investments from Berkshire now?

The biggest reason for this is that Larson seems to sell Microsoft shares by selling Berkshire stake. The share of Berkshire shares in the portfolio in the second gay of 2022 in the portfolio is 53.56 %and Microsoft’s share in portfolio is 1.37 %. In the third Ceyreg of 2023, the share of Berkshire shares in portfolio to 23.32 %decreases Microsoft’s share in portfolio to 26.91 %. Therefore, the biggest reason for Larson selling Berkshire shares seems to buy a Microsoft share. After 2022, the ratio of Berkshire in the portfolio continues to decrease, but after this decrease, the microsoft shares show the increase in the portfolio signal in Microsoft from Berkshire.

Another share in the portfoy is observed as CNI. Since 2007, the share in portfolio Median, which is 5.69 %of the CNI, has been around 17 %after the third quarter. This also signals that there are drastic changes in the portfolio after 2022 as in Berkshire. So why did Larson decided to entertain CNI’s share in the portfolio? Thanks to its rich dividend history, CNI Gaze Carpiyor as a company that resists time. The strategic position makes CNI a vital connection between Canada and several major US cities, which makes it an important player in cross -border logistics solutions. The company also performs above the average on the financial front.

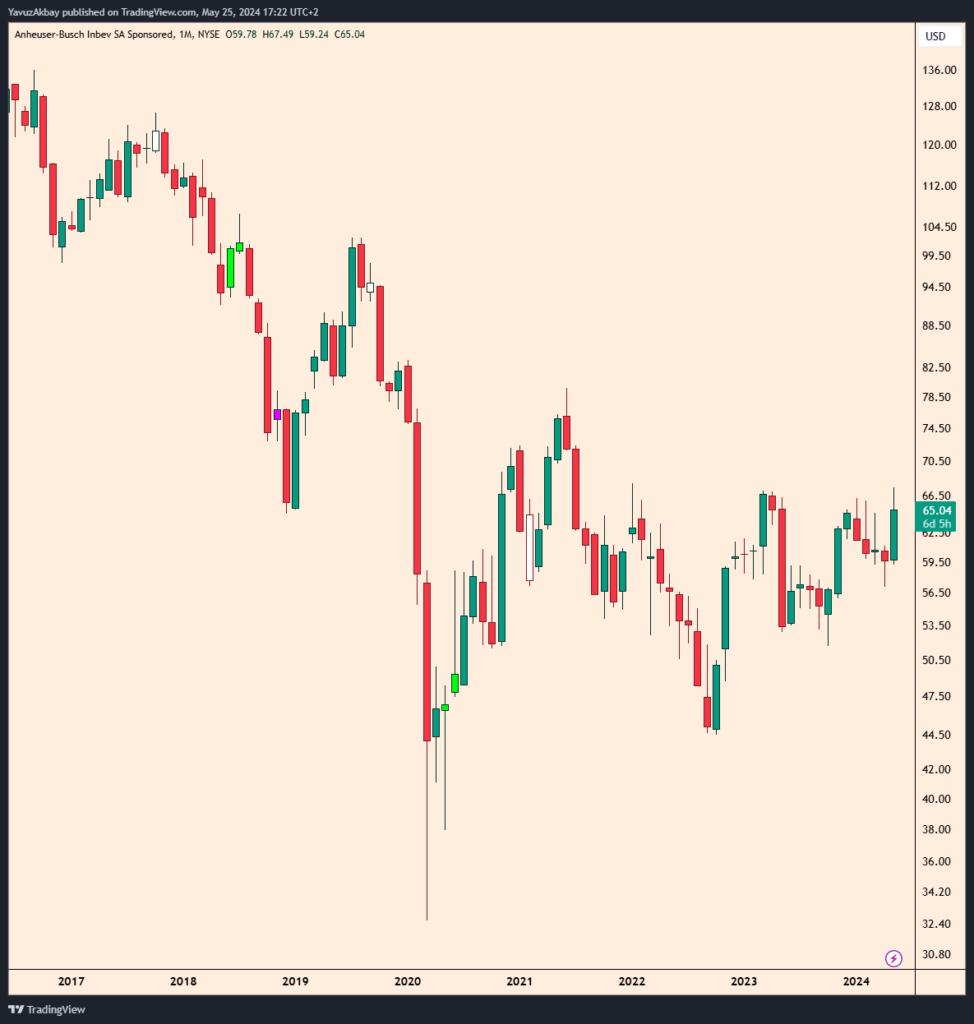

In 2022, one of the shares that suddenly fell shares is Walmart. Larson Median 4.22 %Portfoy share WMT shares up to 1.22 %we see that the strategy is going. In addition, the share of UPS in portfolio was around 2.31 %and decreased to 0.28 %. Coca Cola, Fedex, Crown Castle in the same way after 2022, a harsh portfolio share is a fell. Are these companies only reduced for Microsoft investment? No. The shares that are added to the post -2022 portfo appear as WCN, KHC, HRL, DHR, CVNA, BUD.

There are various reasons for the addition of Portfoye BUD. First of all, the price of BUD shares will be attracted to $ 132 from $ 132 to $ 44. In addition, the addition of Portfoye Heineken also shows the attention of Bill Gates portfolio to the beer endustry. The opportunities in this endustry should be evaluated.

Suddenly, the share of the shares of the portfolio in the portfolio since 2007 since 2007 is a slow and continuous share of WM. Considering that Bill Gates has spent most of the last decade of social and environmental initiatives through the Foundation, companies that contribute to more sustainability probably appeal to him at a personal level. Garbage and recycling companies benefit from effective trenches in their markets due to high obstacles to the sector. This makes these stocks a very safe long -term holdings when combined with the necessity of garbage collection services in all market conditions. Therefore, the fact that these businesses dealt with most of the US recycling makes shares more solid.

In general, I can say that it is focused on portfolio and focused on solid dividend revenues. Pre -2022 portfolio, especially for years, consisting of companies that have been proved and proved in the company, while 2022 after the newly offered companies were added to the portfo. Although there was no technology company in the pre -2022 portfolio, the technology sector was entered after 2022. In addition, as we reach 2022 from 2007 to 2022, we are witnessing that the portfolio starts to develop with technique by getting out of financial and basic analysis. After that, if the shares with large share in the portfolio are reduced, I think that it will probably be reduced to add a company that hosts a more risky, more new and more technical. Portfoy is out of a conservative and traditional line, as if it is going into a more risky line than before. I think this is not bad because I thought it was too much conservative than the portfolio. In fact, let me tell you, even Gates’ close friend Buffet’s portfolio is much more fun than this portfolio.