House prices in Germany dropped by a record 10.2pc in the third quarter in a further sign of the struggles faced by Europe’s largest economy since the pandemic.

It was the fourth consecutive quarter of declines compared to the same time a year earlier, and the biggest since Germany’s statistics office began keeping records in the year 2000.

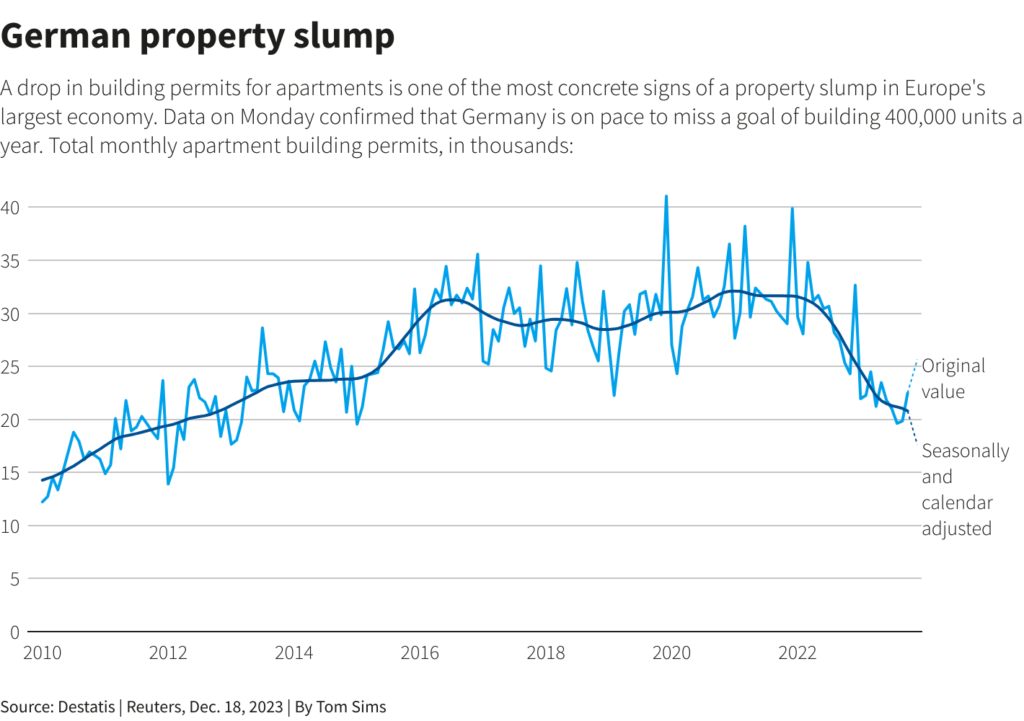

The drop comes amid the biggest property crisis in decades in Europe’s largest economy.

Konstantin Kholodilin of the German Institute for Economic Research said: “Until 2022, there was a speculative price bubble in Germany, one of the biggest in the last 50 years.

“Prices have been falling ever since. The bubble has burst.”

For years, the property sector in Germany and elsewhere in Europe boomed as interest rates were low and demand strong.

But a sharp rise in rates and costs has put an end to the run, tipping developers into insolvency as bank financing dries up and deals freeze.

It comes as official data showed Germany is the worst performing G7 economy since the pandemic, growing by just 0.3pc.

Britain slipped back behind France to be the next worst performer after downward revisions to growth left the UK on the brink of recession.

Germany’s mighty economy is in trouble and a recession is unavoidable there. There will however be plenty of opportunities for private equity funds to capitalize on dislocations in that economy during the next two years.

Although real estate remain strong in metro areas such as Munich where is a big influx of workers, domestic and foreign. In less attractive geographies prices have dropped of various cited reasons. More important question from my perspective is – will Germany be able to grow and compete effectively in next 10-15-20 years with countries that either benefit from immigration of skilled workers such as US, or countries that have huge internal markets and workforce such as China and India.