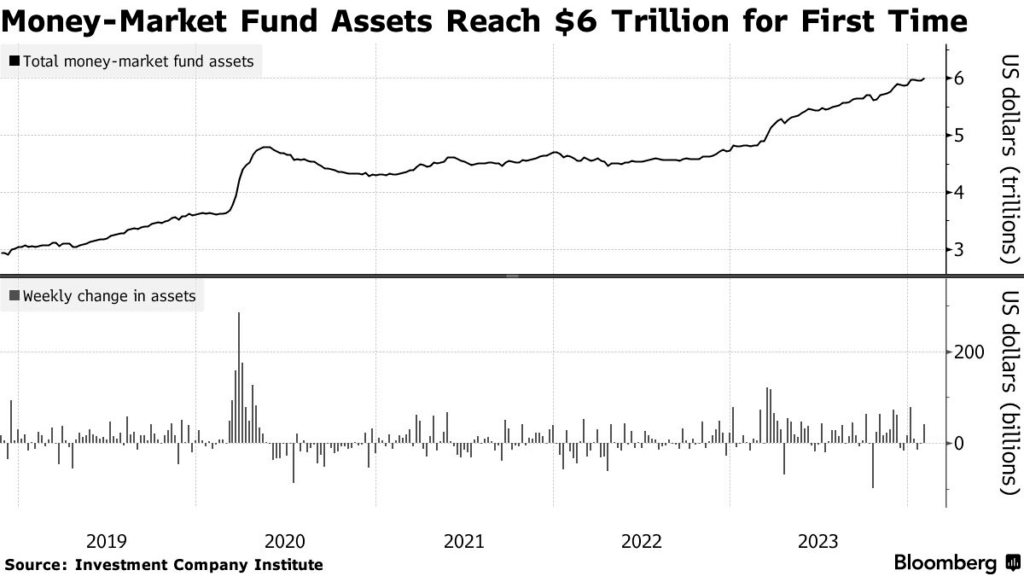

In the ever-evolving landscape of investment, few indicators carry the weight of cash yields surpassing those of the stock market. Yet, here we stand in 2024, witnessing an unprecedented phenomenon: cash now yields higher returns than stocks, echoing a trend last observed over two decades ago. This shift, marked by investors parking a staggering $6 trillion in cash, raises many questions about market sentiment, risk aversion, and the potential for significant market movements.

The surge in assets held within Money Market Funds, catapulting from $5 trillion to $6 trillion in a mere 12 months, is a testament to the palpable apprehension looming over traditional investment avenues. For seasoned investors like Ray Dalio, who once deemed cash as “trash,” this paradigm shift signals a notable departure from conventional wisdom. In a world where interest rates on cash have soared to a 23-year high, the allure of stability coupled with positive returns becomes increasingly enticing.

Historically, cash has often played second fiddle to stocks, with its yields trailing behind inflation rates. However, the current scenario paints a starkly different picture, with cash offering a rare haven of stability amidst economic uncertainty. Unlike the stock market, prone to volatile fluctuations, cash presents a sanctuary shielded from market turbulence.

The implications of this monumental shift extend far beyond mere portfolio diversification. With $6 trillion in cash reserves poised on the sidelines, the debate rages on: does this signify an impending market crash or a harbinger of a potential market surge? Analogies drawn from past instances, such as the deployment of cash leading to substantial stock market rallies in 2002 and 2009, offer both cautionary tales and rays of hope.

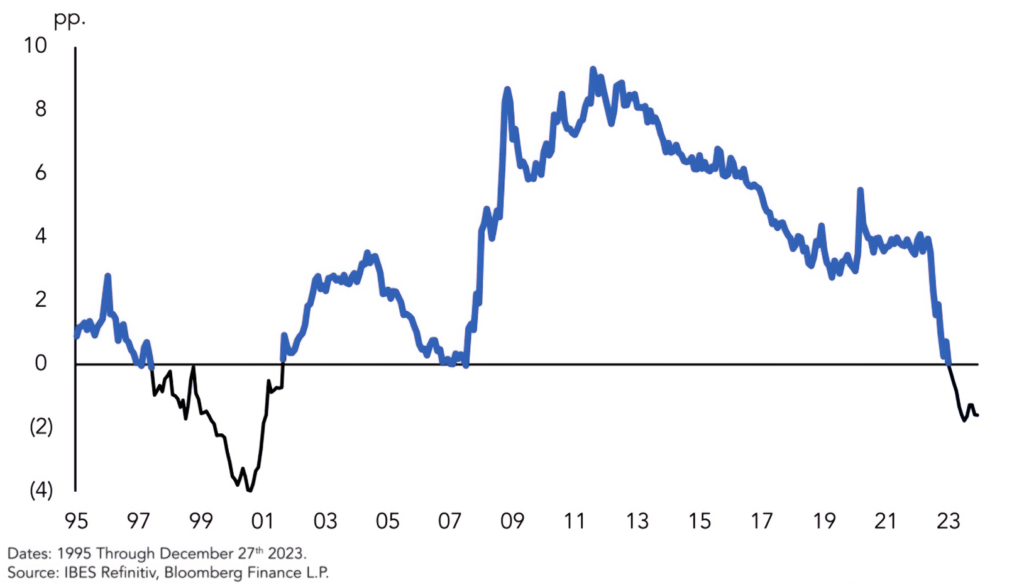

However, the disparities between the current landscape and those of yesteryears warrant meticulous scrutiny. Unlike previous periods, where cash yields languished at meager levels, today’s cash offers attractive returns, presenting investors with a compelling alternative to traditional equities. Concurrently, the dwindling earnings yield of the S&P 500 paints a subdued picture of stock market profitability, further tilting the scales in favor of cash.

Yet, amidst the allure of cash, cautionary whispers of past market downturns linger. The rare occurrence of cash yields surpassing those of stocks, reminiscent of the tumultuous days of 1999, serves as a poignant reminder of the fragility inherent in market dynamics. As history has shown, elevated cash yields can often foreshadow periods of market turbulence, underscoring the inherent risks associated with such anomalies.

While the allure of a 5% cash yield may seem irresistible in the current climate, it pales in comparison to the long-term average returns offered by stocks. The inherent trade-off between risk and reward remains ever-present, with investors grappling with the delicate balance between stability and growth.

As market expectations pivot towards potential declines in short-term rates, the attractiveness of cash yields only amplifies. Yet, amidst the allure of stability, the specter of unforeseen inflation looms ominously on the horizon, threatening to disrupt the delicate equilibrium.

In conclusion, the surge in Money Market Funds assets and the unprecedented phenomenon of cash yielding higher returns than stocks paint a nuanced portrait of market sentiment. While the allure of stability beckons investors towards cash reserves, the allure of higher returns in equities remains a tantalizing prospect. As investors navigate these uncharted waters, the age-old adage rings true: proceed with caution, for the only certainty in the markets is uncertainty itself.