Following the release of FedEx Corporation’s fiscal 2024 Q2 earnings report, the company’s stock price fell precipitously due to a large shortfall on both sales and earnings per share (EPS). Together with revenue of $21.6 billion, the company reported adjusted EPS of $3.60, considerably behind the consensus forecast of $4.77 by more than $300 million. This performance highlights a more general trend of weakening economic conditions, which is especially affecting the shipping and logistics industry.

Earnings Details:

There are other underlying concerns that are reflected in the difference between FedEx’s actual and forecasted earnings. First of all, there has been a discernible decline in the demand for its offerings. This fall in demand is not unique to FedEx; rather, it is a reflection of an uneven global trend in which the economy has recovered, with some industries, like as e-commerce, seeing a plateau or decline following an unparalleled boom in the early stages of the global health crisis. FedEx has also had to deal with increased fuel prices and a shift in services that are less profitable, which has negatively impacted the mix of its revenue.

Guidance Adjustments:

Additionally, FedEx lowered its full-year guidance, indicating to investors that the rest of the fiscal year would be cautious. In sharp contrast to its original projection, which predicted flat revenue growth, the company now projects a low single-digit percentage loss in revenue for the entire year. This update is a reaction to what FedEx refers to as unstable macroeconomic circumstances that are driving up demand from customers for all of its transportation services.

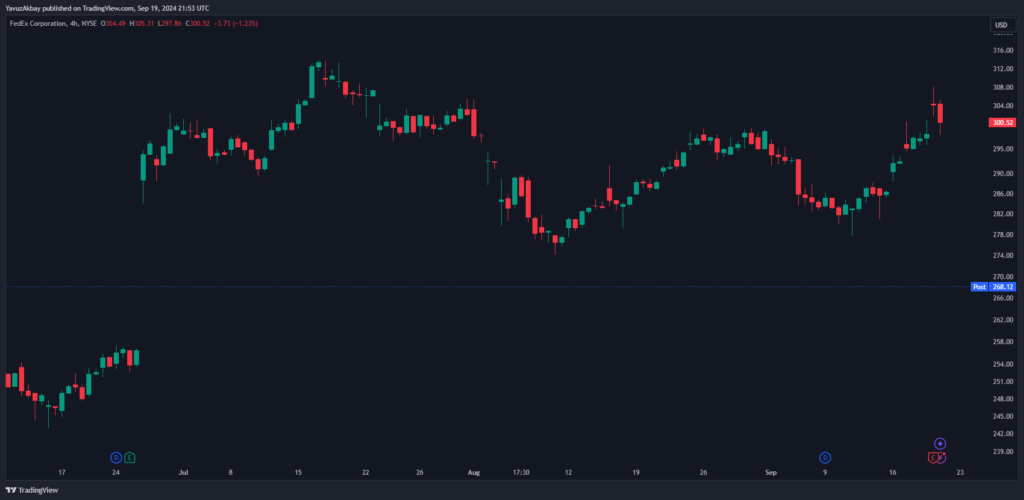

Market Reaction:

FedEx’s shares fell precipitously in after-hours trading following the results announcement, a sign of investor dissatisfaction and doubts about the company’s capacity to weather difficult market circumstances. This response addressed the missing earnings as well as potential wider ramifications for the logistics sector, which may recover from economic shocks more slowly than expected.

Strategic Considerations:

FedEx’s cost-cutting approach has paid off, as the corporation has increased its profit margins in spite of declining revenues. If demand does not increase, this strategy might not be viable in the long run. To grab new segments or recoup lost market share, the corporation may need to complement its critical focus on operational efficiency with creative service offers or market development tactics.

Economic Implications:

FedEx’s lower-than-expected earnings and updated forecast are a sign of how well consumer behavior and international trade are doing. One of the biggest logistics companies in the world has signaled a decline in demand, which implies that consumers and businesses may still be in a cautious spending phase, especially in industries where physical goods movement plays a significant role. This scenario might spur additional research into the evolution of global supply chains, which could hasten the trend toward regionalization or more flexible logistics.